unified estate and gift tax credit 2021

Any tax due is. 2020-45 which sets forth inflation-adjusted items for 2021 or various provisions of the Internal Revenue Code.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

The unified tax credit changes regularly depending on.

. The estate and gift tax exemption is 117 million per individual up from 1158. In October 2020 the IRS released Rev. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Or of course you can use the unified tax credit to do a little bit of both. ESTATE AND GIFT TAXES Estate Taxes 2021 2020 Estate tax exemption 11700000 11580000 Unified estate tax credit 4577800 4577800. The unified credit against estate and gift tax in 2022 will be.

Then there is the exemption for gifts and estate taxes. The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

If you die in 2020 after making such a taxable gift you will still be able to transfer. In the case of estate and gift taxes the unified tax credit provides a set amount that any individual can gift during their lifetime before any of these two taxes apply. After 2025 the exemption will revert to the 549 million exemption adjusted for inflation.

Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of 55 to a n exemption of 1158. Your available Unified Credit is effectively reduced from 1158 million to 11 million. In 2011 the estate tax was reinstated - so the unified tax credit was reinstated as well.

The Estate Tax is a tax on your right to transfer property at your death. An estate paid only the higher of the two. When an estate is below the unified gift and estate tax credit.

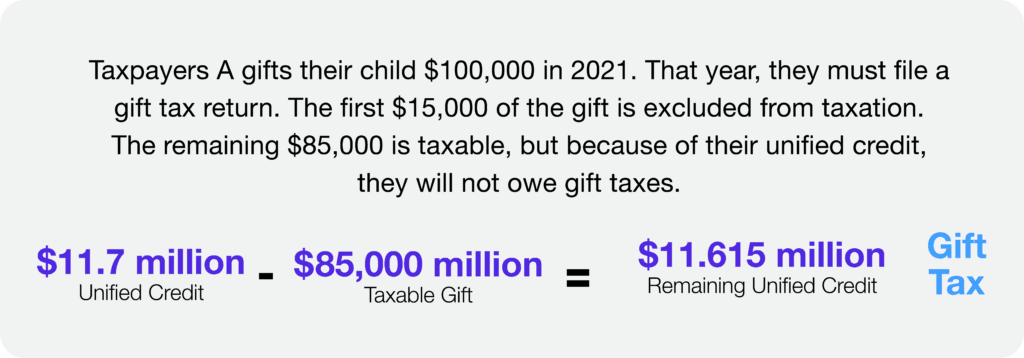

In New Jersey the Inheritance Tax was a credit against the Estate Tax. For 2021 the annual exclusion for gifts is 15000. The unified tax credit rolls the gift and estate tax exclusions into one tax system and decreases the individuals or estates tax bill dollar for dollar.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The gift and estate tax. The 2021 federal tax law.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. Gift and Estate Tax Exemptions The Unified Credit. The Unified Tax Credit represents the amount of assets that an individual is allowed to gift to other parties without having to pay gift estate or generation-skipping.

The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death. Unified estate tax credit. Wednesday January 20 2021.

Annual Gift Exclusion for 2021. Beginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021.

The unified tax credit changes regularly depending on regulations related to estate and gift taxes. Or of course you can use the unified tax credit to do a little bit of both. Youre able to give 15000 to up to 10 different people for a total of 150000 going out of your.

In 2010 the federal estate tax and the unified tax credit was repealed. For 2009 tax returns every American received an automatic unified tax credit against federal estate and gift taxes of 1455800 which is equivalent to transferring 35. This of course could remain subject to change.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The 117 million exception in 2021 is set to expire in 2025. A person giving the gifts has a lifetime exemption from paying taxes.

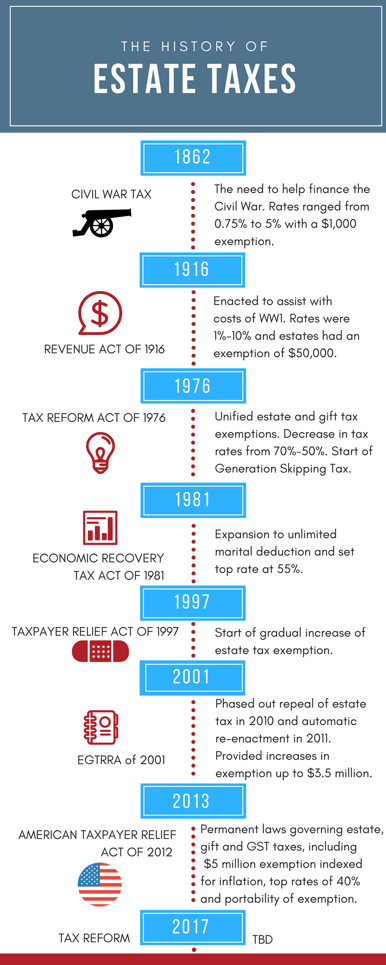

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. What Is the Unified Tax Credit Amount for 2021. In 1976 Congress unified the gift and estate tax regimes thereby limiting the givers ability to circumvent the estate tax by giving during his or her lifetime.

What Is the Unified Tax Credit Amount for 2021. The New Jersey Estate Tax was phased out in two parts. The Internal Revenue Service announced today the official estate and gift tax limits for 2021.

What Is the Unified Tax Credit Amount for 2021. The unified tax credit changes regularly depending on. The unified tax credit is a term encompassing two or more tax exemptions that taxpayers can use in combination to transfer substantial amounts of assets to heirs without triggering the need to.

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax In The United States Wikiwand

Top Estate Planning And Estate Tax Developments Of 2021

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Exploring The Estate Tax Part 2 Journal Of Accountancy

U S Estate Tax For Canadians Manulife Investment Management

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Warshaw Burstein Llp 2022 Trust And Estates Updates

A Brief History Of Estate Gift Taxes

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Talk To Clients About Estate Taxes Lifetime Gifts Corvee

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

U S Estate Tax For Canadians Manulife Investment Management

2021 Tax Laws Federal Tax Updates Maryland Estate Taxes Mcnamee Hosea